For Comprehensive Financial Therapy and Recommendations, Contact Us Now

For Comprehensive Financial Therapy and Recommendations, Contact Us Now

Blog Article

Why Prioritizing Your Financial Wellness Consists Of Seeking Professional Credit Score Therapy Solutions for Sustainable Debt Alleviation

In a world where economic choices can considerably affect our future and present health, the importance of seeking specialist credit rating coaching services can not be overstated. Attaining sustainable debt alleviation includes even more than just making repayments; it needs a calculated strategy that attends to the origin triggers of financial distress. By employing the advice of experts in credit history therapy, individuals can obtain beneficial insights, resources, and support to browse their way in the direction of economic security. This opportunity uses a holistic perspective on handling financial debt and creating a course in the direction of a safe economic future.

Advantages of Specialist Credit Counselling

Engaging in experienced credit scores therapy can give individuals with customized monetary strategies to successfully take care of and lower their financial debt worry. By examining a client's economic circumstance thoroughly, debt counselors can develop customized financial obligation monitoring plans that suit the person's specific demands and goals.

Moreover, experienced credit scores therapy solutions usually supply important education on monetary literacy and cash management. Overall, the advantages of professional credit scores counseling expand past financial obligation alleviation, assisting individuals develop a strong foundation for long-lasting monetary well-being.

Comprehending Financial Obligation Alleviation Options

When facing frustrating debt, people should very carefully evaluate and comprehend the various readily available options for financial obligation relief. One common financial obligation relief alternative is financial obligation combination, where multiple financial obligations are incorporated right into a solitary financing with a lower passion rate.

Bankruptcy is an extra drastic financial debt alleviation alternative that must be considered as a last resource. It involves a legal process where financial debts are either restructured or forgiven under the defense of the court. Nonetheless, bankruptcy can have resilient consequences on credit rating and financial future. Looking for specialist credit scores therapy solutions can help individuals analyze their financial situation and figure out one of the most ideal debt relief option based upon their details scenarios.

Creating a Personalized Financial Plan

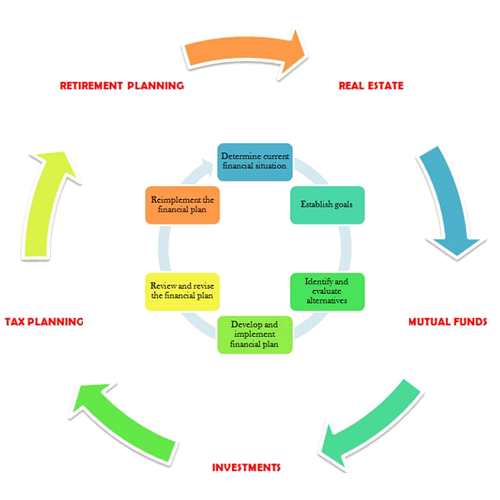

Thinking about the various financial obligation alleviation alternatives readily available, it is essential for individuals to create a customized financial plan customized to their specific circumstances. A customized monetary strategy serves as a roadmap that lays out a clear course in the direction of achieving monetary stability and flexibility from financial obligation.

Next, setting sensible and specific economic objectives is critical. These objectives might include repaying a specific quantity of financial obligation within a defined duration, boosting savings, or enhancing credit history. With clear goals in position, individuals can after that create a budget that assigns funds towards financial debt settlement, savings, and necessary expenses. Routinely readjusting this budget and keeping track of as required is important to stay on track towards monetary goals.

In addition, seeking specialist sites credit history therapy solutions can provide important support and support in developing a personalized monetary plan. Credit rating counselors can use professional recommendations on budgeting, financial obligation monitoring strategies, and monetary preparation, aiding individuals make informed decisions to safeguard a steady economic future.

Value of Budgeting and Saving

Reliable financial management via budgeting and saving is essential to achieving long-term financial stability and success. Budgeting enables individuals to track their revenue and expenses, allowing them to focus on costs, recognize locations for potential cost savings, and prevent unneeded financial obligation. By producing a budget plan that lines up with their monetary objectives, individuals can effectively prepare for the future, whether it be constructing a reserve, conserving for retired life, or purchasing assets.

Conserving is similarly critical as it supplies a monetary safeguard for unexpected expenditures and assists people work towards their financial objectives. Establishing a normal saving practice not just fosters financial self-control yet likewise ensures that individuals have funds offered for unanticipated scenarios or future possibilities. Furthermore, saving allows individuals to grow their wide range with time via rate of interest build-up or financial investment returns. In essence, conserving and budgeting are cornerstone techniques that encourage people to take control of their funds, minimize monetary tension, and job in the direction of attaining lasting financial protection.

Long-Term Financial Security

Accomplishing long-term monetary security is a tactical search that necessitates cautious planning and disciplined economic management. To protect long lasting financial wellness, individuals have to concentrate on building a strong economic structure that can endure unanticipated expenditures and financial changes. This structure includes developing an emergency fund, taking care of financial obligation sensibly, and spending for the future.

One secret aspect of lasting monetary stability is developing a lasting budget that aligns with one's financial objectives and top priorities. Planning for retired life very early and consistently contributing to retirement accounts can assist individuals secure their economic future.

Verdict

Finally, looking for expert credit scores therapy solutions is necessary for attaining lasting financial obligation relief and long-term financial security. By recognizing financial debt alleviation choices, establishing a customized economic strategy, and focusing on budgeting and conserving, people can successfully handle their financial resources and job in the direction of a protected financial future. With the assistance of credit score counsellors, individuals can make informed choices and take positive steps towards improving their financial health.

A tailored financial plan offers as a roadmap that lays out a clear path towards attaining economic stability and liberty from debt. In significance, conserving and budgeting are foundation techniques that equip individuals to take control of their finances, reduce monetary anxiety, and job in the direction of accomplishing lasting financial safety.

To safeguard enduring economic well-being, people should focus on developing a solid financial structure that can withstand financial variations and unanticipated expenditures - contact us now. By leveraging professional advice, people can browse monetary difficulties more successfully and function in the direction of a sustainable financial obligation alleviation strategy that supports their long-term financial wellness

Report this page